34+ Calculate Property Tax California

Web As a fundamental rule property taxes in California are obtained by taking the propertys current tax-assessed value and multiplying it by the states property tax. The BOE acts in an oversight capacity to ensure compliance by county assessors with property tax laws regulations and assessment issues.

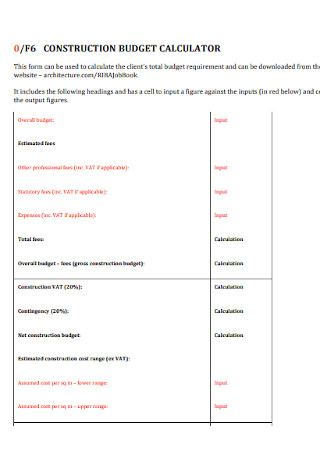

34 Sample Budget Calculators In Pdf Ms Word

The assessed value of your.

. Web Estimate My California Property Tax. Web How is the amount calculated. Calculating property tax in California involves the aforementioned components.

California Income Tax Calculator 2022-2023. Web The California Property Tax Calculator provides a free online calculation of ones property tax. If you make 70000 a year living in California you will be taxed.

Web Property taxes in California are calculated by the state-approved 1-percent rate Mello-Roos taxes parcel taxes and any additional local government taxes and. Identify the applicable tax rate which is a percentage set by. Web California income tax calculator.

Web Find out the assessed value of the property which is typically determined by the county assessors office. Our California Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax. Web How is Property Tax Calculated in California.

Use Our Fast 100 Free Calculator to Get Your Houses Estimated Value. Remaining Income 51825. California State Tax Brackets.

Tax amount varies by county. Web Riverside County homeowners pay a median annual property tax payment of 3827 which is 758 lower than the median real estate taxes paid in California. Are there ways to lower these costs legally so that you can maximize your investments.

Plan Your Property Investment Returns With AARPs Investment Property Calculator. Web Our California Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to. Web To calculate the exact amount of property tax you will owe requires your propertys assessed value and the property tax rates based on your propertys address.

This comprehensive guide is designed to shed. Simply type in the propertys zip code and select the assessed home. Ad Property Can Be An Excellent Investment.

SmartAssets California paycheck calculator shows your hourly and salary income after federal state and local taxes. Enter your info to see your. Customize using your filing status deductions exemptions and more.

Total Estimated Tax Burden. Web Find out how much youll pay in California state income taxes given your annual income. Ad Calculate Your Houses Estimated Market Value in Less Than 2 Minutes.

074 of home value. Calculate Understand Your Potential Returns. California tax brackets have a large.

The median property tax in California is 283900 per year for a home worth the median value of.

15325 Masonwood Dr Gaithersburg Md 20878 Mls Mdmc738514 Trulia

2021 Personal Income Tax Booklet California Forms Instructions 540 Ftb Ca Gov

Bdcoeqsjdhlr1m

34 Sample Budget Calculators In Pdf Ms Word

California Property Tax Calculator

California Property Tax Calculator

11550 Mushroom Trail Rough And Ready Ca 95975 Compass

Amazon Com 2023 Upgrade Launch X431 Pro3s Elite Bluetooth Bi Directional Scan Tool Oem Topology Mapping Hd Trucks Scan Online Coding 37 Service For All Cars Full System Diagnostic Key Immo 2 Year Free Update Automotive

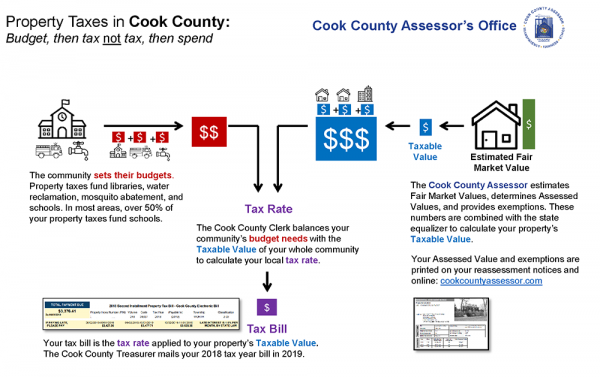

Why Your Chicago Property Tax Bill Is So High Lucid Realty

Property Tax Calculator Estimator For Real Estate And Homes

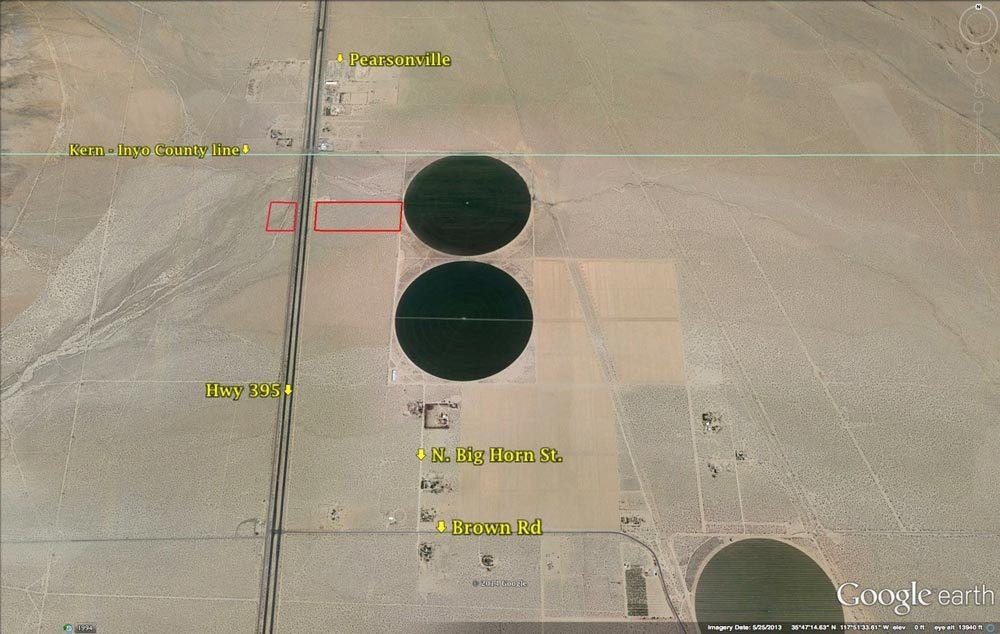

395 Inyo County Border Inyokern Ca Inyokern Ca 93527 Compass

California Tax Calculator

Property Tax Calculator

Hl1 2022 Q1 Q4 Luxury Market Report Denise Drake By Hawaii Life Issuu

203 Satterfield Road Luttrell Tn 37779 Compass

Ports Harbors Pdf

11053 Riverside Dr Jurupa Valley Ca 91752 Crexi Com